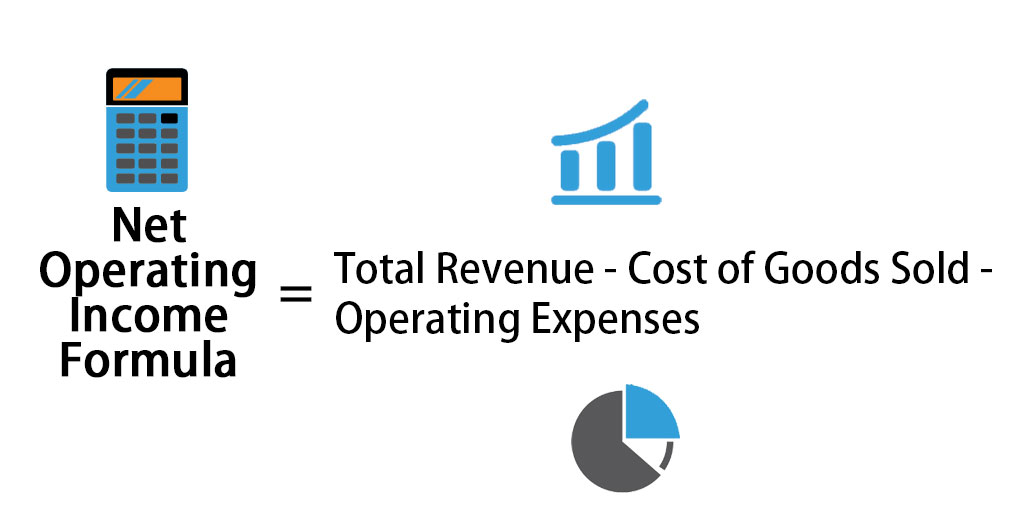

Lenders want to feel comfortable that a business has sufficient working capital and liquidity to support its operations. For example, they will look at projections of changes in the current ratio, current assets divided by current liabilities, under different economic conditions to make sure that enough liquidity is being maintained. After this, use your costs and revenue projections to find out what your future net income might be. Keep in mind, expenses can be fixed or variable, and they are calculated as a percentage of sales. You can calculate a base percentage of sales by averaging sales over a certain time frame, and then use that percentage to estimate your projections. This would be helpful to lenders and partners who might otherwise be alarmed at such a negative performance.

- There are various software solutions for real estate, the most famous one being ARGUS.

- This includes activities specific to operating, financing and investing.

- Add back depreciation to capital expenditure, which is arrived at on the cash flow statement.

- In some countries, customs may accept a pro forma invoice if the required commercial invoice is not available at the time when filing entry documents at the port of entry to get goods released from customs.

Not addressing the critical details of business documents can negatively impact you. While it’s helpful to know what a company’s management has planned, it’s important to view these projections with skepticism. Nobody can predict the future, and managers might use overly optimistic assumptions in their pro formas. A pro forma cash flow statement could detail any payments involved in a hypothetical project.

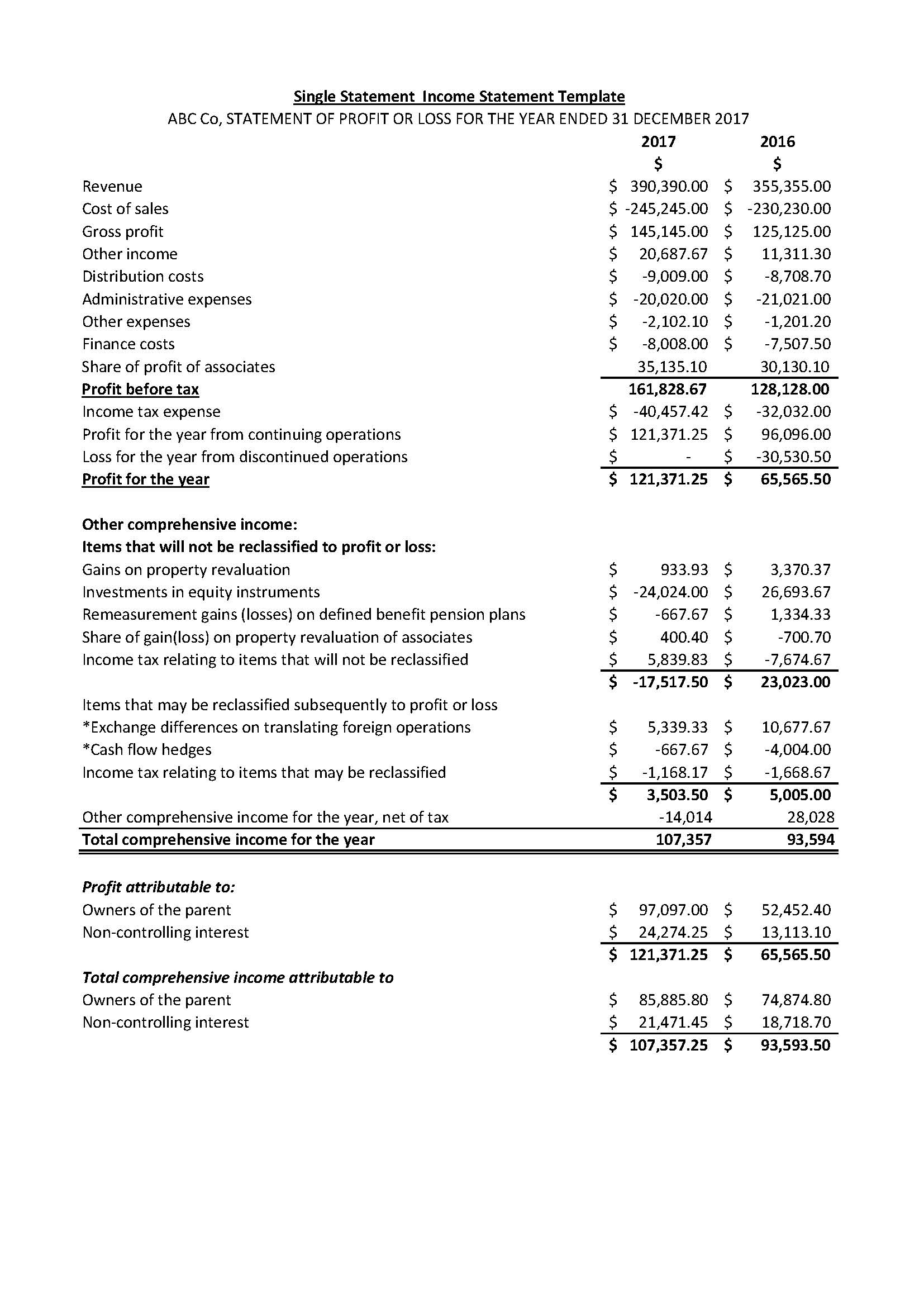

A pro forma financial statement offers projections of what management expects to happen under a particular set of circumstances and assumptions. Standard financial statements are based on a company’s historical performance. In contrast, the purpose of pro forma financial statements is to look to the future or to analyze hypothetical scenarios of what could be. They do not include one-time items and do not conform to Generally Accepted Accounting Principles . This is done by taking the difference between revenue, or sales and expenses, or the costs involved in doing business. On a pro forma income statement, revenue is calculated based on events that could increase or decrease sales.

Pro forma definition

That’s why real estate investors use a pro forma to make sure their financial projections are as accurate as possible. Stessa instead of an Excel spreadsheet to keep track of rental property income, expenses, and other deductions to generate accurate financial reports such as income statements and net cash flow reports. Pro forma financial statements present the company’s predicted or current financial information based on several assumptions and speculative circumstances that may or may not have transpired. If your company must produce an introductory paragraph with its pro forma documents, it should describe the content of your pro forma documents. This means that it should define the transaction, the entities involved, and the periods of time. In this paragraph, you should offer a high-level explanation of the limitations and assumptions the pro forma documents were produced under.

- Often requested by banks, they may also be prepared as a part of the annual budgeting or forecast and estimate where cash shortages may occur in order to obtain additional funding.

- These reports provide key stakeholders, investors, and creditors the foresight needed to make decisions and strategically plan.

- Understanding this methodology and the decisions behind it will enable accurate comparisons and information to investors.

- To prepare a pro forma statement, you can use a financial statement template or pro forma sample spreadsheets, like these from Smartsheet.

- “Pro forma” is a Latin phrase that means “as a matter of form.” It works well in many business situations, but you need to know whether it’s written as one or two words (or whether it’s hyphenated).

Added net income from the pro forma income statement to the accompanying balance sheet and statement of cash flows. We’re going to take you through the steps necessary to create a basic full-year pro forma projection using an income statement, cash flow statement, and balance sheet. However, we’re lobbing another caveat your way – take our walk-throughs with a grain of salt since they’re only a glimpse into the basic pro forma process. In this last example, we will prepare a pro forma cash flow statement in Excel.

Emoji dictionary

OK so for restaurant bookkeeping, this is how we’re going to build an income statement. Long before we’re ready to start collecting money we will likely be setting up forecasts to project our startup’s performance. “Pro forma” is a Latin phrase that means “as a matter of form.” It works well in many business situations, but you need to know whether it’s written as one or two words (or whether it’s hyphenated). In the federal government of the United States, either house of the Congress can hold a pro forma session at which no formal business is expected to be conducted. They have also been used to prevent presidents from making recess appointments.

Restructuring CostsRestructuring Cost is the one-time expense incurred by the company in the process of reorganizing its business operations. It is done to improve the long term profitability and working efficiency. This expenditure is treated as the non-operating expenses in the financial statements. Let us look at the various types of the pro forma income statement in business plan. Creating a pro forma statement in Excel from scratch is pretty straightforward.

Use these models to test the goals of a company’s plan, provide findings that may be understood, and offer better, more accurate data than other methods. New financial models use computer programs that has made this testing better, which enables quick calculation for real-time decision making. Pro forma analyses are meant to paint a better picture of what is happening with the company, irrespective of one-time events, but considering the specific industry’s standards. In some respects, this type of analysis is a more accurate depiction of the company’s financial health and outlook. Further, organizations may want to develop their pro forma financial statements while they are doing an annual review of their business plan.

Pro forma templates

The assumptions will frame most of what the rest of the income statement will show, like our revenue or variable expenses. Creating an accurate pro forma is critical because various rental property financial metrics such as cap rate, cash-on-cash return, and ROI all depend on a good pro forma analysis. As a remote real estate investor you would expect a cap rate of 7.4% with the property management fee factored in, based on the above pro forma. For example, if you are selling a property, a pro forma can be used to predict the change in NOI and property value if the vacancy rate increased from 5% to 10%.

In business, pro forma has some special meanings; a pro forma invoice, for example, will list all the items being sent but, unlike a true invoice, won’t be an actual bill. However, under GAAP financial statements, amortization and depreciation are considered expenses because there is a loss in the value of the assets. Add net income from the income statement to the balance sheet and cash flow statement. For businesses that previously acted as a partnership or sole proprietorship that are being acquired into a corporation, the statements must reflect that of the acquiring business. This includes that business’ net sales, cost of sales, gross profit on sales, expenses, other income and deductions, and income before taxes. These are often intended to be preliminary or illustrative financials that do not follow standard accounting practices.

Understanding Pro Forma Invoices

When deciding whether or not to invest in a company or a project, it’s reasonable to wonder how the future will unfold. There’s no way to predict the future with certainty, but you can analyze multiple “what if” scenarios to understand the potential outcomes. Pro forma financial statements enable investors to do that with available information.

As businesses grow, they often need to secure additional funding. If outside funds are needed, pro forma statements can help present the expected future results to lenders and other investors. Managers can use pro forma statements for a variety of reasons to illustrate the effects of executive decisions or expected changes in business.

First, make a typical financial statement, such as a cash flow statement. Then, choose one column to amend with hypothetical figures to match various scenarios. The statement of cash flow indicates the amount of money that goes in and out of a business. This includes activities specific to operating, financing and investing.

They can show the projection of what money will be tied up in receivables, equipment, and inventory. Further, they can represent if your company could run out of money, and how much is necessary to keep it afloat. If your company has a high debt-to-equity ratio, it will show on the balance sheet. Use the balance sheet template below to create your own balance sheet. This pro forma balance sheet can also be used for corporate retail or wholesale businesses.

It Is Annual Report Time—Recent Developments and Trends for the … – JD Supra

It Is Annual Report Time—Recent Developments and Trends for the ….

Posted: Thu, 12 Jan 2023 08:00:00 GMT [source]

For example, if your https://1investing.in/ recently acquired or dispensed with another company, the assumptions would be the changes in finance expected. The limitations should discuss the challenges of predicting the financial future of a company. It may be tempting to think of a pro forma statement as the same as a business budget. But budgets and pro forma statements are two distinct financial tools.

Gender & Sexuality dictionary

My employers and clients uniformly appreciate my ability to negotiate and close transactions quickly and effectively, and to make the complex simple. Among other things, I can efficiently assist you on entity formation, governance, and structure; HR issues; mergers and acquisitions; and the negotiation and drafting of all types of commercial contracts. I’m the proud recipient of multiple Martindale-Hubbell Client Distinction Awards given only to the top 5% of attorneys for quality of service. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate. Specific documentation is required before goods can pass through customs in the U.S. We don’t expect you to understand all of this immediately — we sure didn’t.

Word of the Day: pro forma – The New York Times

Word of the Day: pro forma.

Posted: Thu, 21 Apr 2022 07:00:00 GMT [source]

While pro forma financial statements project the future, there is no guarantee that those predictions are accurate. Unexpected events, bad assumptions, and other factors can lead to dramatically different results. Keep in mind that the general process of creating pro forma financial statements isn’t significantly different from that of creating traditional statements.

S&P GLOBAL REPORTS 4th QUARTER AND FULL-YEAR 2022 … – S&P Global Investor Relations

S&P GLOBAL REPORTS 4th QUARTER AND FULL-YEAR 2022 ….

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

It’s possible that we might grow out of this tool in 6 months and need something more customized or complex. We’ve used this same tool to manage businesses with 8 figures of revenue and it’s scaled wonderfully. Our focus here is to track how much revenue and expense we have on any given month, but that doesn’t tell us how much cash we have left in the bank.

Everything we do — from how we handle marketing to who we recruit to whether this idea really makes any sense — will map back to the income statement. Many entrepreneurs base all of their operating activities and growth plans from their pro-format income statement. In trade transactions, a pro forma invoice is a document that states a commitment from the seller to sell goods to the buyer at specified prices and terms. It is not a true invoice because it is not used to record accounts receivable for the seller and accounts payable for the buyer.

Pro forma figures should be clearly labeled as such and the reason for any deviation from reported past figures clearly explained. Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. In fact, business owners, investors, creditors, and other key decision-makers all use pro forma financial statements to measure the potential impact of business decisions. Compiled pro forma financial statements can form the basis for calculating financial ratios and financial models, which test assumptions and relationships of your company’s plan. You can use them to study how changes in the price of labor, materials, overhead, and the cost of goods affect the bottom line.