Contents:

If a company runs its operations out of the United States and all its factories are located in the United States, it would need U.S. dollars to run and grow its operation. Thus, if the U.S.-based company were to do business with a Japanese company and receive Japanese yen, it would need to exchange the yen into U.S. dollars. Hedge accounting is a practice that allows the change in the value of a financial instrument, such as a mortgage, to be offset by the change in the value of the corresponding hedge.

Hedge accounting of the foreign currency risk arising from a net investment in a foreign operation will apply only when the net assets of that foreign operation are consolidated. The amendments in the new standard will permit more flexibility in hedging interest rate risk for both variable rate and fixed rate financial instruments, and introduce the ability to hedge risk components for nonfinancial hedges. The objective in developing the new standard was to better align the accounting rules with a company’s risk management activities, and to simplify the application of the hedge accounting standard. Hedge accounting is designed to ensure that hedging instruments and hedged items both receive similar accounting treatment. Companies can use hedge accounting for transaction exposures, such as forecasted purchases, revenues and expenses in foreign currencies.

ECONOMIC HEDGES ARE DIFFERENT FROM ACCOUNTING HEDGES

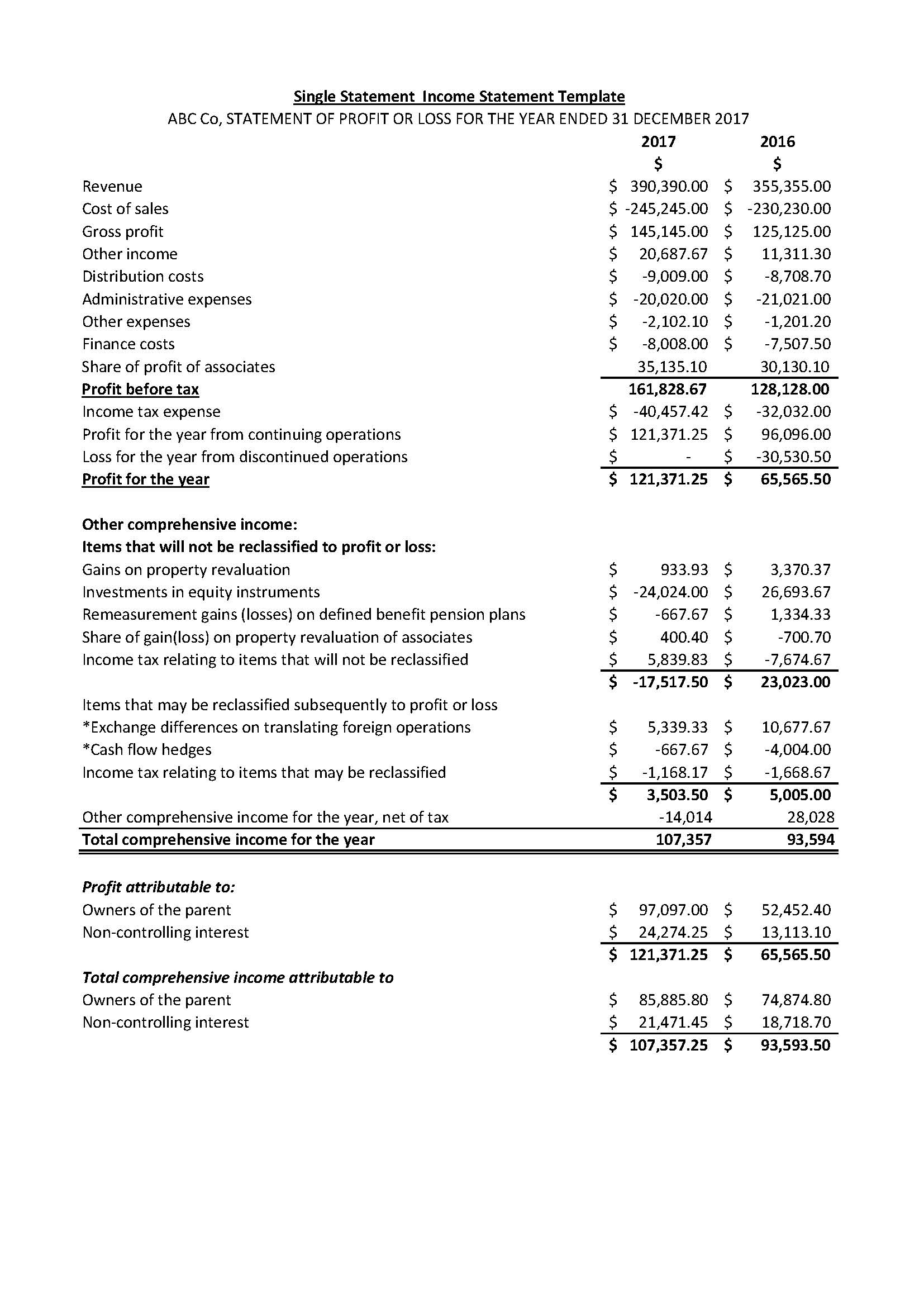

Derivatives are presented as assets when the fair value is positive and as liabilities when the fair value is negative. A cash flow hedge is used to reduce the exposure to volatility of cash flows from an existing asset or liability or a forecasted transaction. In order to qualify for hedge accounting, the potential changes in cash flows from the asset, liability, or future transaction must have the potential to affect the company’s reported earnings. Examples of items that may qualify for cash flow hedging include variable interest rate assets or liabilities, assets or liabilities denominated in a foreign currency, forecasted purchases or sales, and forecasted debt issuances. Hedge accounting is accounting for financial instruments and contracts used to hedge investments or other exposures.

If hedge accounting is not applied, changes in the fair values of derivative instruments are recognized in earnings in each reporting period, which may or may not match the period in which the risks that are being hedged affect earnings. Therefore, the objective of hedge accounting is to match the timing of income statement recognition of the effects of the hedging instrument with the timing of recognition of the hedged risk. Hedge accounting involves offsetting changes in the fair value of a financial instrument with changes in the fair value of a paired hedge. Hedges are used to reduce the risk of losses by taking on an offsetting position in relation to a financial instrument.

Financial instruments — Effective date of IFRS 9

It is https://1investing.in/ value with changes in fair value recorded through the income statement. Changes in value of the hedged item due to the risk being hedged is recorded as an adjustment to the asset or liability through the income statement in the same account line item as would normally be used for the underlying asset or liability. Derivative instruments are measured at fair value each reporting period with changes in fair value reported in earnings. If the purpose of the derivative is for risk management or hedging, this measurement method may not always align with the value of the item being hedged.

- The argument for hedge accounting, then, is that it more accurately reflects the economic reality and avoids misleading investors.

- That’s why the FASB wanted to make sure whoever applies hedge accounting conscientiously designs a hedge that is as effective as possible.

- This means that if the value of the loan changes, the value of the financial instrument used to hedge it will change in the opposite direction, offsetting the loss.

- An entity may want to protect itself from changes in the economic value of an asset, liability, or future commitment.

- These include forecasted fixed-rate borrowing, variable-rate assets and liabilities.

IFRS 9 requires only prospective assessment of hedge effectiveness on an ongoing basis, at inception of the hedging relationship and at a minimum when a company prepares annual or interim financial statements. Unlike IFRS 9, US GAAP requires a prospective and a retrospective assessment whenever financial statements are issued or earnings are reported, and at least every three months. Many financial institutions and corporate businesses use derivative financial instruments to hedge their exposure to different risks (for example interest rate risk, foreign exchange risk, commodity risk, etc.). Some entities mitigate certain risks by entering into separate contracts that meet the definition of a derivative instrument.

Cons of hedge accounting

This is meant to reduce volatility created by repeated adjustments, a process also known as ‘mark to market’ or fair value accounting. For example, gold mines are exposed to the price of gold, airlines to the price of jet fuel, borrowers to interest rates, and importers and exporters to exchange rate risks. Hedge accounting is an accountancy practice, the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account.

Kyriba automates the mark-to-market process to calculate valuations for all derivatives. Kyriba’s valuation engine allows clients to run valuations across their entire portfolio whenever needed during the month. Valuations use market rates and curves from Kyriba’s Market Data service, while market information can also be accessed from third-party platforms. Kyriba’s audit logs and information storage offer complete transparency to the valuation process.

types of hedge accounting

Under a cash flow hedge, the hedging instrument is measured at fair value, but any gain or loss that is determined to be an effective hedge is recognised in equity, i.e. under cash flow hedge reserve. This is intended to avoid volatility in the statement of profit and loss in a period when the gains and losses on the hedged item are not recognised therein. These swings impact the income statement, showing volatility that does not reflect the economic benefit of the hedge.

Since the value of hedging instruments fluctuates along with market conditions, hedge accounting is an effective way for companies to stabilise gains and losses. If a company subsequently modifies the critical terms of a hedging relationship, the company may be required under US GAAP to dedesignate the original hedging relationship and in that case may designate a new hedging relationship that incorporates the revised terms. Without hedging, a company would be exposed to foreign currency risk, leading to losses in its accounts. Hedging can help protect against this risk, but the accounting treatment of hedges can sometimes result in mismatches between the hedged item and the hedge. Three that do are forward contracts, purchased options and certain combination options. While hedging is used to reduce a portfolio’s volatility, hedge accounting applies to the corresponding financial statements.

There are other ways companies save money when hedging that considers seasonality and other factors that make forecasting difficult. With either of these strategies, your company can look to a longer period to complete hedged transactions, as long as you document the strategy and test the timing difference appropriately. With the right knowledge and tools, these methods can be helpful alternatives to more traditional hedging programs. Reduce the cost and complexity of applying hedge accounting by simplifying the way assessments of hedge effectiveness may be performed. There are numerous resources available on accounting for derivatives and hedging under both ASC 815 and IFRS 9.

Versor Investments LP Makes Significant Investment in Real Estate … – Best Stocks

Versor Investments LP Makes Significant Investment in Real Estate ….

Posted: Fri, 14 Apr 2023 19:32:10 GMT [source]

This is because full how to write a receipt accounting provides the most accurate reflection of the economic protection achieved from a hedge and provides the most useful information to users of the financial statements. Other providers offer multiple technologies to achieve what Kyriba delivers in a single cloud portal. Kyriba’s solution simplifies the support for your hedging program, but offers premium product performance, managed upgrades and eliminates IT dependencies. An entity should satisfy the broader disclosure requirements by describing its overall financial risk management objectives, including its approach towards managing financial risks. Disclosures should explain what the financial risks are, how the entity manages the risk and why the entity enters into various derivative contracts to hedge the risks.

The accounting standards do not dictate what method you use to prove effectiveness prospectively and retrospectively. The choice of method depends on the nature of risk and type of hedge you have structured. However, the method must be formally documented at inception of the hedge relationship and applied consistently to all similar hedges, unless another method is justified. The intent behind hedge accounting is to allow a business to record changes in the value of a hedging relationship in other comprehensive income , rather than in earnings. This is done in order to protect the core earnings of a business from periodic variations in the value of its financial instruments before they have been liquidated. Once a financial instrument has been liquidated, any accumulated gains or losses stored in other comprehensive income are shifted into earnings.

„Interest rates, commodity prices, and foreign currency exchange rates have all been significantly impacted, and companies may be able to achieve lower costs of borrowing, purchasing, and interacting in foreign markets.“ „Most derivatives are economic hedges, which entities enter into for risk management rather than speculative purposes,“ Goswami said. „There is a distinction between an economic hedge and an accounting hedge, and ASC Topic 815 has specific and complex guidance on when an economic hedge can be treated as an accounting hedge.“ The company in this example has a long-term fixed rate loan but would prefer a variable rate loan.

In investment circles, the term “hedge fund” is used to describe a financial vehicle that can offset market volatility. This is often done with derivatives, or options, that represent an opposing position from a primary investment. Think equity bought at a certain price with an option to sell it at a set price to mitigate losses. A user was unable to grasp an entity’s risk management activities of an entity based on the traditional way of accounting. Matching ConceptThe Matching Principle of Accounting provides accounting guidance, stating that all expenses should be recognized in the income statement of the period in which the revenue related to that expense is earned. This means that, regardless of when the actual transaction is made, the expenses that are entered into the debit side of the accounts should have a corresponding credit entry in the same period.